Rep. Powell Assigned to COVID-19 Economic Recovery Task Force

State Representative Jena Powell (R-Arcanum) is named by Speaker Householder (R-Glenford) to the OHIO 2020 Task Force.

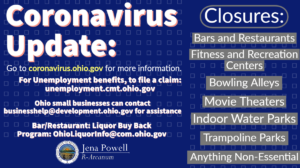

“We are walking unchartered territory due to COVID-19 right now,” said Rep. Powell. “While we are doing everything we can to keep Ohioans healthy, we also need to continue looking at the economics factors that are associated with COVID-19 in preparation for recovery when this pandemic ends. I am grateful that Speaker Householder set up this task force so we can continue the conversation on a statewide basis to ensure businesses and families have the ability to survive and thrive both short-term and long-term.” Speaker Larry Householder today named 24 legislators to the bipartisan task force that will study ways the Ohio House can lay the foundation for economic recovery from the COVID-19

pandemic.

Speaker Householder said that as the critical work of doctors, nurses, first responders and public health leaders continues in an effort to keep Ohioans safe and healthy, it’s equally important to focus on planning Ohio’s economic recovery. “Prior to COVID-19 coming to our shores, our nation was experiencing perhaps the best economic time in its history,” Householder said. “The policies that needed to be put in place have flattened two curves, one regarding the spread of the virus, the other regarding our economy. Ohio needs to get healthy and back to work as soon as possible,” according to Speaker Householder. Speaker Householder continues, “The COVID-19 pandemic has impacted all aspects of our lives, including the economic well-being and future of Ohio families and businesses. What are the barriers to economic recovery? How do we help Ohio’s families and employers recover and emerge stronger than before? This is a critical time for Ohio’s future. I believe we can rebound from this challenge in a better position than anyone in the nation if we plan ahead and implement

well.”

The panel will begin meeting remotely today. There will be guests each meeting from the business, manufacturing, retail, wholesale, services and recreational sectors to discuss their experience and brainstorm ways to rebound Ohio’s job market once COVID-19 has ran its course.

Rep. Powell says, “If you want to provide input from my community to me regarding our economic recovery, email Rep80@ohiohouse.gov or call the office at 614-466-8114 so that I can be a voice for you on this task force.”

As always, if you have any questions, please reach out to our office at 614-466-8114 or Rep80@ohiohouse.gov.